pay estimated indiana state taxes

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Some states also require estimated quarterly taxes.

The Indiana personal exemption includes a 1500 additional exemption for dependent children the exemption for non-minor dependents is 1000.

. Residents of Indiana are taxed at a flat state income rate of 323. Line I This is your estimated tax installment payment. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

You will receive a confirmation number immediately after paying. If you did make estimated tax payments either they were not paid on time or you did not pay. You can send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or via your mobile device using the IRS2Go app.

Line I This is your estimated tax installment payment. Take the renters deduction. Pay my tax bill in installments.

Your average tax rate is. Pay my tax bill in installments. Have more time to file my taxes and I think I will owe the Department.

How do I pay estimated taxes for 2020. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. You can also pay your estimated tax payments using the IRS2Go app.

Have more time to file my taxes and I think I will owe the Department. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

17 2022 without having to pay late filing penalties. Take the renters deduction. This means you may need to make two estimated tax payments each quarter.

Know when I will receive my tax refund. Select the Make a Payment link under the Payments tile. Find Indiana tax forms.

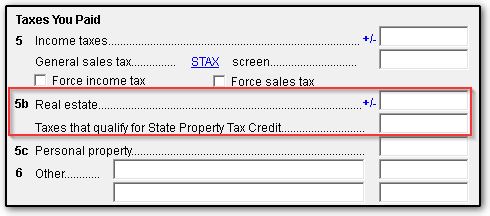

One to the IRS and one to your state. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. Able to claim exemptions.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Additional local income tax for each county 035 to 338 no state-level payroll tax. Find Indiana tax forms.

The tax bill is a penalty for not making proper estimated tax payments. Indianas statewide income tax has decreased twice in recent years. Follow the links to select Payment type enter your information and make your payment.

Learn about state requirements for estimated quarterly tax payments. In addition to the above distributions below is the certified revenue to be generated by local income tax rates imposed within the county for the following purposes. Claim a gambling loss on my Indiana return.

It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond. To make an individual estimated tax payment electronically without logging in to INTIME. Some customers pay with pre-printed estimated tax vouchers while others complete a form IT-6 IT-41or IT-40ES or ES-40 and mail a check or make an online.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The income tax is a flat rate of 323. 822022 Jail LIT 891009.

Indiana state income taxes for 2021 may be prepared and e-filed along with your IRS federal income tax return and the deadline for this April 18 2022Those eligible for extensions can e-file until Oct. Cookies are required to use this site. There may be late tax payment penalties to deal with though.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. Indiana Income Tax Calculator 2021. Claim a gambling loss on my Indiana return.

Estimated payments may also be made online through Indianas INTIME website. 081 average effective rate. Your browser appears to have cookies disabled.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. Ad No Money To Pay IRS Back Tax.

STATE OF INDIANA County 60 Owen Certified Shares Revenue 4455047 IC 6-36-6-3a2 Distribution 1113762 Certified Shares Distribution 3341285. Indiana counties local tax rates range from 050 to 290. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

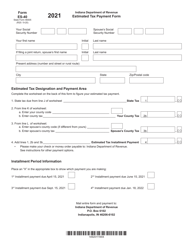

If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40 fully updated for tax year 2021. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Those rates taken alone would give. That means no matter how much you make youre taxed at the same rate. Access INTIME at intimedoringov.

The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income. Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay.

Know when I will receive my tax refund. Indiana tax year starts from July 01 the year before to June 30 the current year. For a complete list of payment alternatives go to IRSgovpayments.

Dor Owe State Taxes Here Are Your Payment Options

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana Dept Of Revenue Inrevenue Twitter

Indiana State Tax Information Support

Indiana Dept Of Revenue Inrevenue Twitter

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Owe State Taxes Here Are Your Payment Options

Indiana Sales Tax Small Business Guide Truic

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Income Tax Calculator Smartasset

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Dept Of Revenue Inrevenue Twitter

Dor Keep An Eye Out For Estimated Tax Payments

Indiana Dept Of Revenue Inrevenue Twitter

Dor Indiana Extends The Individual Filing And Payment Deadline